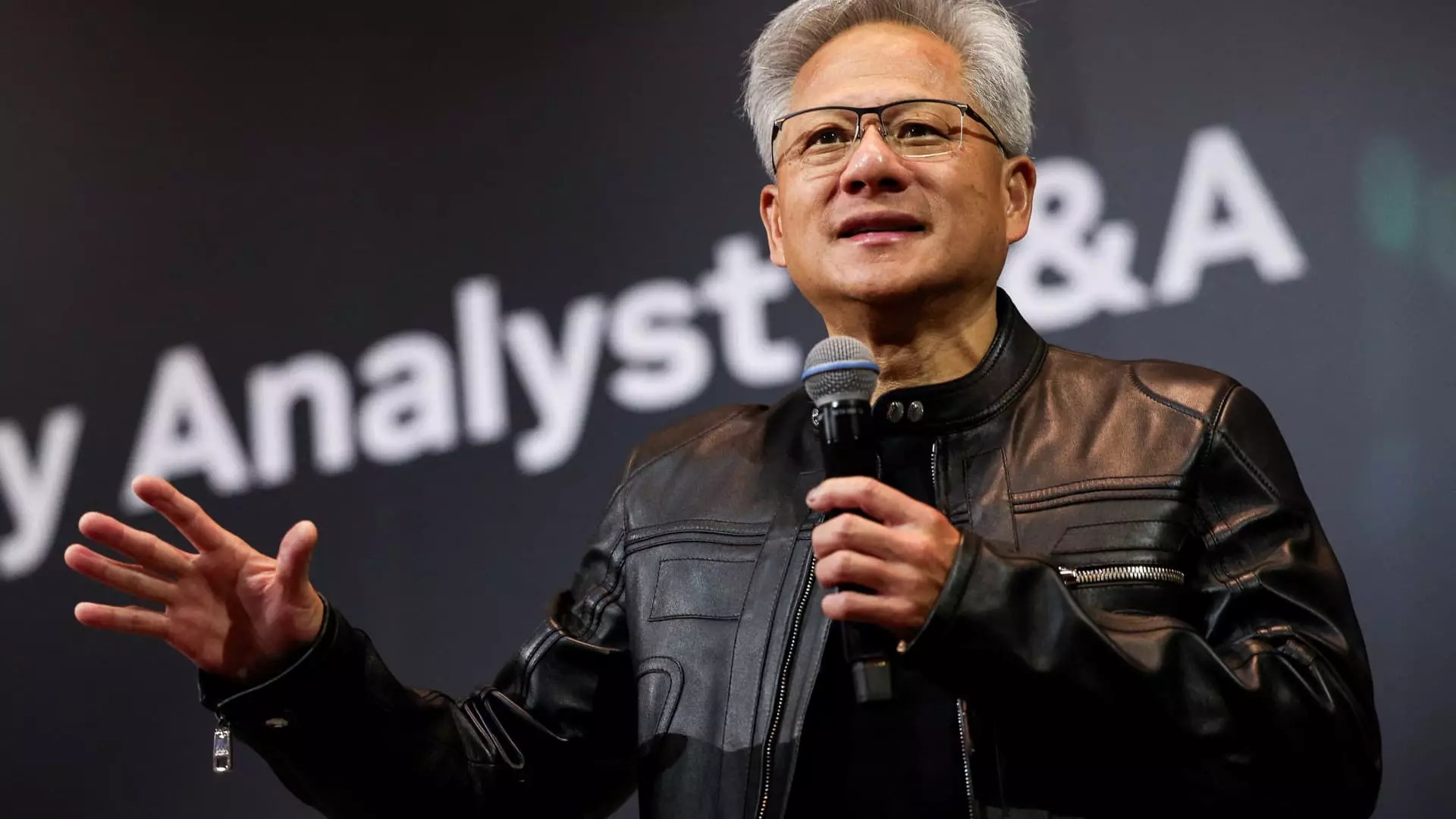

Nvidia’s CEO Jensen Huang recently made headlines by elevating Taiwan Semiconductor Manufacturing Co. (TSMC) to a status of near-legendary stature, calling it “one of the greatest companies in the history of humanity.” Such a statement is not merely corporate flattery; it’s a strategic affirmation of TSMC’s pivotal role in the global technology supply chain. In an era where geopolitical tensions heavily influence semiconductor manufacturing, Huang’s glowing praise positions TSMC as a resilient, essential pillar of innovation. His statement implicitly underscores the importance of TSMC’s advanced manufacturing capabilities, especially in cutting-edge AI chips, which are rapidly transforming industries worldwide.

This endorsement also highlights Nvidia’s deep reliance on TSMC’s technological leadership. With multiple projects underway to develop next-generation chips, including specialized processing units for AI, Nvidia’s future growth is intricately tied to TSMC’s manufacturing excellence. By publicly expressing admiration and urging investors to see TSMC as a “smart” investment, Huang endeavors to bolster confidence in the Taiwanese giant at a critical juncture where U.S.-China rivalry over technology supply chains is intensifying.

The Geopolitical Chessboard: The U.S. Government’s Increasing Footprint in Semiconductor Supply Chains

While Nvidia lauds TSMC’s technological prowess, the broader political landscape is rife with the strategic maneuvering of Western powers aiming to secure dominance over semiconductor manufacturing. The U.S. government’s efforts, driven by the CHIPS Act, seek to participate more actively in chip production and ownership by providing substantial grants and exploring equity stakes in leading firms. The recent discussions about the federal government acquiring minority shares in companies like TSMC and Intel signals an aggressive shift from supporting industrial expansion to direct influence.

However, the execution of these plans remains complex and fraught with diplomatic nuance. For instance, reports indicate that the U.S. aims to take a 10% stake in Intel amidst broader intentions to increase U.S. manufacturing capacity. But publicly, government officials deny any immediate plans to acquire stakes in firms that are expanding domestically, aiming to assuage concerns about overreach and maintain cordial relations with Asian semiconductor powerhouses. Nonetheless, the message is clear: Washington is increasingly viewing semiconductor assets as strategic assets that could bolster national security and economic strength.

This dual approach — passive investment versus active state ownership — reveals a calculated gamble. The U.S. desires to foster technological independence without alienating key Asian manufacturers like TSMC and Samsung, which are vital to the global supply chain. TSMC’s substantial expansion in Arizona and the promise of billions in federal funding further complicate this landscape, as the company navigates geopolitical pressures while expanding its American footprint.

Nvidia’s Regional Strategy and Its Broader Economic Implications

Nvidia’s own initiatives, such as the planned expansion of its Taiwan operations into a new office, reflect a strategic effort to solidify its local talent pool and streamline its supply chain. CEO Huang’s remarks about the company’s commitment to hiring engineers and collaborating with Taiwanese supply chain partners underline a recognition that geographic proximity and local expertise are indispensable for maintaining technological leadership.

Yet, this regional growth is also intertwined with geopolitical complexity. Reports emerged that Nvidia requested component suppliers to halt production of certain chips due to Chinese security concerns, highlighting the delicate balance between technological advancement and national security. The China-U.S. tech tug-of-war impacts Nvidia’s strategic decisions, especially regarding the export of advanced chips like the H20 general processing units, which are caught in export restrictions and security scrutiny.

This scenario underscores a larger reality: Nvidia’s global strategy must now contend not only with market competition but also with geopolitical realities. The company’s willingness to cooperate with governments and adjust its operations suggests an adaptive approach, but it also underscores the fundamental vulnerability of relying on global supply chains that are increasingly politicized.

The Future of Semiconductor Power: A New Era of Strategic Alliances

Looking ahead, the semiconductor landscape is poised for fundamental shifts, with corporations positioning themselves as geopolitical actors rather than mere market players. Nvidia’s praise for TSMC signals a recognition that technological innovation alone is insufficient; strategic alliances, regulatory navigation, and geopolitical savvy will determine leadership in the next era.

The rising tide of U.S. investments and potential government stake acquisitions in semiconductor firms can be seen as attempts to reshape global supply chains, reducing reliance on China and ensuring technological sovereignty. TSMC’s substantial investment expansion in the U.S., coupled with Nvidia’s operational growth in Taiwan, exemplifies a bifurcation of the supply chain that could lead to dual manufacturing hubs—one aligned with the West, the other with Asia.

That division, however, invites questions about resilience and global cooperation. Will these regional silos lead to innovation stagnation, or will they foster a new competitive order? The power dynamics are shifting towards a landscape where corporate giants like Nvidia wield influence comparable to states, shaping policies and alliances in pursuit of strategic dominance.

In this evolving scenario, TSMC’s leadership in the industry—marked by technological excellence and strategic investments—cements its role as an indispensable player. Nvidia’s public endorsement of TSMC’s stature isn’t just marketing chatter; it’s a declaration that the future of technology hinges on a fragile yet vital network of partnerships and power plays. As these forces collide on the geopolitical stage, the global tech industry must adapt, innovate, and navigate with unparalleled agility to maintain its position at the forefront of innovation.